contents

- • performance highlights

- • chairman’s message

- • ceo’s message

- •

- • board of directors

- • senior management

- • M1 and the community

- • investor relations

- • corporate governance

- • particulars of directors

- • particulars of senior management

- •

- • major properties

- • statistics of shareholdings

- • corporate information

notes to the financial statements

For the Financial Year Ended 31 December 2010

1. Corporate information

M1 Limited (the “Company”) is a public limited liability company, which is incorporated and domiciled in the Republic of Singapore and is listed on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Its registered office and principal place of business is at 10 International Business Park, Singapore 609928.

The principal activities of the Company and its subsidiaries (collectively, the “Group”) are the provision of telecommunications services, international call services and broadband services, retail sales of telecommunication equipment and accessories, customer services and investment holding.

2. Summary of significant accounting policies

2.1 Basis of preparation

The consolidated financial statements of the Group and the statement of financial position and statement of changes in equity of the Company have been prepared in accordance with Singapore Financial Reporting Standards (“FRS”).

The financial statements have been prepared on the historical cost basis except for derivative financial instruments that have been measured at their fair values.

The financial statements are presented in Singapore dollars (“S$”) and all values are rounded to the nearest thousand (S$’000) except when otherwise indicated.

2.2 Changes in accounting policies

The accounting policies adopted are consistent with those of the previous financial year except in the current financial year, the Group and the Company have adopted all the new and revised FRS and Interpretations of FRS (“INT FRS”) that are effective for annual periods beginning or after 1 January 2010. The adoption of these standards and interpretations did not have any effect on the financial performance or position of the Group. They did however give rise to additional disclosures and revisions to accounting policies.

The principal effects of these changes are as follows:

-

FRS 103 Business Combinations (revised)

The revised FRS 103 introduces a number of changes to the accounting for business combinations that will impact the amount of goodwill recognised, the reported results in the period that an acquisition occurs, and future reported results. Changes in significant accounting policies resulting from the adoption of the revised FRS 103 include:

- - Transaction costs would no longer be capitalised as part of the cost of acquisition but will be expensed immediately;

- - Consideration contingent on future events are recognised at fair value on the acquisition date and any changes in the amount of consideration to be paid will no longer be adjusted against goodwill but recognised in profit or loss;

- - The Group elects for each acquisition of a business, to measure non-controlling interest at fair value, or at the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets, and this impacts the amount of goodwill recognised; and

- - When a business is acquired in stages, the previously held equity interests in the acquiree is remeasured to fair value at the acquisition date with any corresponding gain or loss recognised in profit or loss, and this impacts the amount of goodwill recognised.

According to its transitional provisions, the revised FRS 103 has been applied prospectively, and does not impact the Group’s consolidated financial statements in respect of assets and liabilities that arose from business combinations whose acquisition dates are before 1 January 2010. The changes will affect future business combinations.

2.3 FRS and INT FRS not yet effective

The Group has not adopted the following FRS and INT FRS that have been issued but not yet effective:

The directors expect that the adoption of the standards and interpretations above will have no material impact on the financial position or financial performance of the Group and Company in the period of initial application.

2.4 Significant accounting estimates and judgements

The preparation of the Group’s consolidated financial statements requires management to make judgements, estimates and assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, and the disclosure of contingent liabilities at the end of each reporting period. However, uncertainty about these assumptions and estimates could result in outcomes that could require a material adjustment to the carrying amount of the asset or liability affected in the future periods.

Key sources of estimation uncertainty

The key assumptions concerning the future and other key sources of estimation uncertainty at the end of each reporting period, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are discussed below:

-

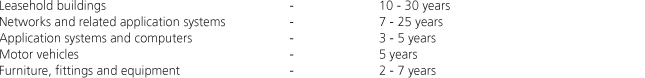

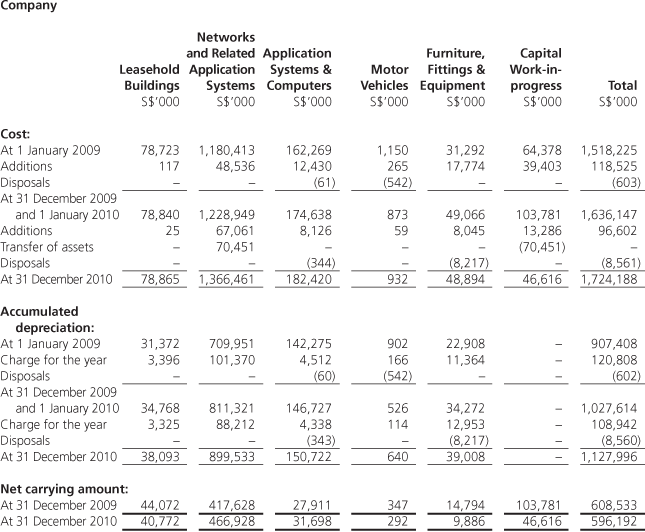

Useful lives of network and related application systems

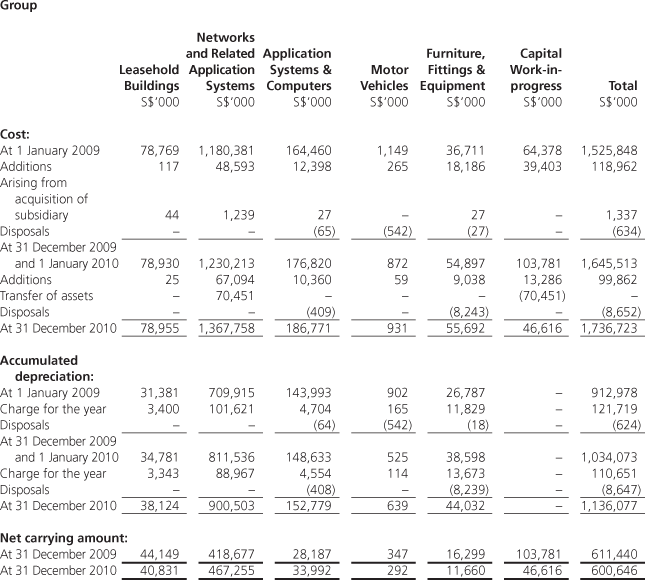

The cost of network and related application systems are depreciated on a straight-line basis over the assets’ estimated economic useful lives. Management estimates the useful lives of these fixed assets to be within 7 to 25 years. These are common life expectancies applied in the telecommunications industry. Changes in the expected level of usage and technological developments could impact the economic useful lives and the residual values of these assets, therefore, future depreciation charges could be revised. The carrying amounts of the Group’s and Company’s network and related application systems at the statement of financial position date are disclosed in Note 10 to the financial statements. -

Impairment of non-financial assets

The Group assesses whether there are any indicators of impairment for all non-financial assets at each reporting date. Goodwill is tested for impairment at least on an annual basis.When value in use calculations are undertaken, management must estimate the expected future cash flows from the asset or cash-generating unit and choose a suitable discount rate in order to calculate the present value of those cash flows. Further details of the key assumptions applied in the impairment assessment of goodwill are given in Note 12 to the financial statements.

-

Impairment of loans and receivables

The Group and the Company assess at each statement of financial position date whether there is any objective evidence that a financial asset is impaired. To determine whether there is objective evidence of impairment, the Group considers factors such as the probability of insolvency or significant financial difficulties of the debtor and default or significant delay in payments.Where there is objective evidence of impairment, the amount and timing of future cash flows are estimated based on historical loss experience for assets with similar credit risk characteristics. Actual results may differ from management’s estimates. The carrying amounts of the Group’s and the Company’s loans and receivables at the statement of financial position date are disclosed in Note 31 to the financial statements.

-

Income taxes

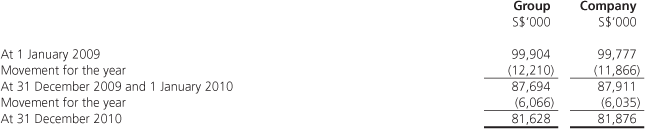

The Group and the Company recognise liabilities for expected tax issues based on estimates of whether additional taxes will be due. Where the final tax outcome of these matters is different from the amounts that were initially recognised, such differences will impact the income tax provisions in the period in which such determination is made. The carrying amount of the Group’s tax payables and deferred tax liabilities at 31 December 2010 were S$41,608,000 (2009: S$39,024,000) and S$81,628,000 (2009: S$87,694,000) respectively. The carrying amount of the Company’s tax payables and deferred tax liabilities at 31 December 2010 were S$41,382,000 (2009: S$35,517,000) and S$81,876,000 (2009: S$87,911,000) respectively.

2.5 Basis of consolidation

Business combinations from 1 January 2010

The consolidated financial statements comprise the financial statements of the Company and its subsidiaries at the end of the reporting period. The financial statements of the subsidiaries are prepared for the same reporting date as the Company. Consistent accounting policies are applied to like transactions and events in similar circumstances.

All intra-group balances, income and expenses and unrealised profits and losses resulting from intra-group transactions are eliminated in full.

Subsidiaries are consolidated from the date of acquisition, being the date on which the Group obtains control, and continue to be consolidated until the date such control ceases.

Business combinations are accounted for by applying the acquisition method. Identifiable assets acquired and liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. Acquisition-related costs are recognised as expenses in the periods in which the costs are incurred and the services are received.

When the Group acquires a business, it assesses the financial assets and liabilities assumed for appropriate classification and designation in accordance with the contractual terms, economic circumstances and pertinent conditions as at the acquisition date. This includes the separation of embedded derivatives in host contracts by the acquiree.

Any contingent consideration to be transferred by the acquirer will be recognised at fair value at the acquisition date. Subsequent changes to the fair value of the contingent consideration which is deemed to be an asset or liability, will be recognised in accordance with FRS 39 either in profit or loss or as change to other comprehensive income. If the contingent consideration is classified as equity, it is not remeasured until it is finally settled within equity.

In business combinations achieved in stages, previously held equity interests in the acquiree are remeasured to fair value at the acquisition date and any corresponding gain or loss is recognised in profit or loss.

Any excess of the sum of the fair value of the consideration transferred in the business combination, the amount of non-controlling interest in the acquiree (if any), and the fair value of the Group’s previously held equity interest in the acquiree (if any), over the net fair value of the acquiree’s identifiable assets and liabilities is recorded as goodwill. The accounting policy for goodwill is set out in Note 2.11(a).

In comparison to the above mentioned requirements, the following differences applied:

Business combinations are accounted for by applying the purchase method.Transaction costs directly attributable to the acquisition formed part of the acquisition costs. The non-controlling interest (formerly known as minority interest) was measured at the proportionate share of the acquiree’s identifiable net assets.

Business combinations achieved in stages were accounted for as separate steps. Adjustments to those fair values relating to previously held interests are treated as a revaluation and recognised in equity.

When the Group acquired a business, embedded derivatives separated from the host contract by the acquiree are not reassessed on acquisition unless the business combination results in a change in the terms of the contract that significantly modifies the cash flows that would otherwise be required under the contract.

Contingent consideration was recognised if, and only if, the Group had a present obligation, the economic outflow was more likely than not and a reliable estimate was determinable. Subsequent measurements to the contingent consideration affected goodwill.

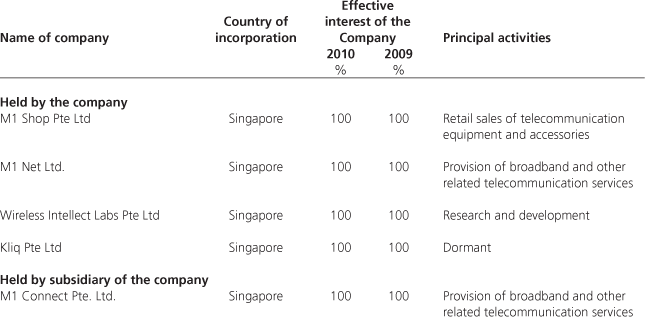

2.6 Subsidiaries

A subsidiary is an entity over which the Group has the power to govern the financial and operating policies so as to obtain benefits from its activities.

In the Company’s separate financial statements, investments in subsidiaries are accounted for at cost less any impairment losses.

2.7 Joint venture

The Group has an interest in a joint venture which is a jointly controlled operation. A joint venture is a contractual arrangement where two or more parties undertake an economic activity that is subject to joint control.

The Group recognises its interest in the joint venture using proportionate consolidation. The Group combines its share of the assets, liabilities, income and expenses of the joint venture with similar items, line by line, in its consolidated financial statements. Consistent accounting policies are applied for like transactions and events in similar circumstances. The joint venture is proportionately consolidated until the date on which the Group ceases to have joint control over the joint venture.

2.8 Fixed assets

All items of fixed assets are initially recorded at cost. The cost of an item of fixed asset is recognised as an asset if, and only if, it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably.

Subsequent to recognition, fixed assets are measured at cost less accumulated depreciation and any accumulated impairment losses.

The initial cost of fixed assets comprises its purchase price, including import duties and non-refundable purchase taxes and any directly attributable costs of bringing the asset to its working condition and location for its intended use. Expenditure incurred after the fixed assets have been put into operation, such as repairs and maintenance and overhaul costs, is normally recognised in profit or loss in the period in which the costs are incurred. In situations where it can be clearly demonstrated that the expenditure has resulted in an increase in the future economic benefits expected to be obtained from the use of an item of fixed asset beyond its originally assessed standard of performance, the expenditure is capitalised as an additional cost of fixed assets.

2.9 Depreciation

Depreciation of an asset begins when it is available for use and is computed on a straight-line basis over the estimated useful lives as follows:

Capital work-in-progress included in fixed assets is not depreciated as these assets are not available for use.

The carrying values of fixed assets are reviewed for impairment when events or changes in circumstances indicate that the carrying value may not be recoverable.

The residual values, useful life and depreciation method are reviewed at each financial year-end to ensure that the amount, method and period of depreciation are consistent with previous estimates and the expected pattern of consumption of the future economic benefits embodied in the items of fixed assets.

An item of fixed assets is derecognised upon disposal or when no future economic benefits are expected from its use or disposal. Any gain or loss on derecognition of the asset is included in profit or loss in the year the asset is derecognised.

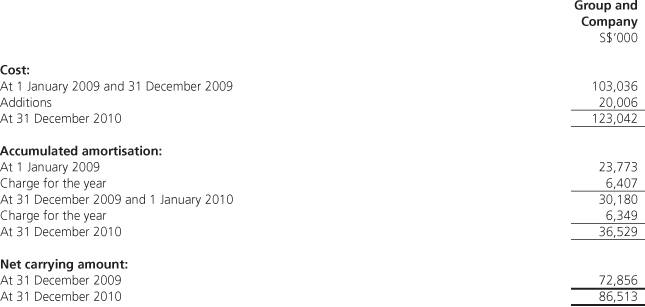

2.10 Licences and spectrum rights

These comprise expenditure relating to one-time charges paid to acquire spectrum rights and telecommunications licences or access codes. These intangible assets are measured initially at cost. Following initial recognition, intangible assets are carried at cost less any accumulated amortisation and any accumulated impairment losses.

Licences and spectrum rights are amortised on a straight-line basis over the estimated economic useful lives of 8 to 17 years. The amortisation period and the amortisation method are reviewed at each financial year-end. The amortisation expense is recognised in profit or loss through the ‘depreciation and amortisation expenses’ line item.

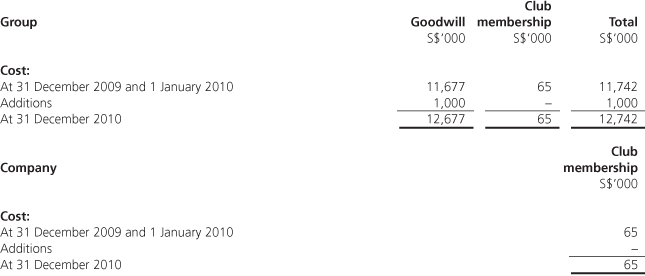

2.11 Intangible assets

| a) | Goodwill Goodwill is initially measured at cost. Following initial recognition, goodwill is measured at cost less accumulated impairment losses. For the purpose of impairment testing, goodwill acquired is allocated, from the acquisition date, to each of the Group’s cash-generating units that are expected to benefit from the synergies of the combination. The cash-generating unit to which goodwill has been allocated is tested for impairment annually and whenever there is an indication that the cash-generating unit may be impaired, by comparing the carrying amount of the cash-generating unit, including the allocated goodwill, with the recoverable amount of the cash-generating unit. Where the recoverable amount of the cash-generating unit is less than the carrying amount, an impairment loss is recognised in the profit or loss. Impairment losses recognised for goodwill are not reversed in subsequent periods. |

| b) | Club membership Club membership acquired is measured initially at cost less any accumulated impairment losses. |

2.12 Financial assets

Financial assets are recognised on the statement of financial position when, and only when, the Group becomes a party to the contractual provisions of the financial instrument.

Non-derivative financial assets with fixed or determinable payments that are not quoted in an active market are classified as loans and receivables. Such assets are initially recognised at fair value, plus directly attributable transaction costs and subsequently carried at amortised cost using the effective interest method. Gains and losses are recognised in profit and loss account when the loans and receivables are derecognised or impaired, as well as through the amortisation process.

Trade and other debtors

Trade and other debtors, including amounts due from related parties, are classified and accounted for as loans and receivables under FRS 39.

Included in the trade debtors balance are accrued service revenue and accrued handset revenue.

Accrued service revenue relate to services rendered but not billed to customers. They will be billed at the following bill cycle.

Accrued handset revenue relates to revenue recognised for handsets sold with services.

Allowance is made for uncollectible amounts when there is objective evidence that the Group will not be able to collect the debt. Bad debts are written off when identified. Further details on the accounting policy for impairment of financial assets are stated in Note 2.14 below.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and on hand and time deposits. They are carried in the statement of financial position, classified and accounted for under FRS 39.

For purpose of the consolidated cash flows statement, cash and cash equivalents are shown net of outstanding bank overdrafts which are repayable on demand and which form an integral part of the Group’s cash management.

2.13 Financial liabilities

Financial liabilities are recognised on the statement of financial position when, and only when, the Group, becomes a party to the contractual provisions of the financial instruments. The accounting policies adopted for specific financial liabilities are set out below.

Borrowings

All borrowings are initially recognised at the fair value of the consideration received less directly attributable transaction costs. After initial recognition, borrowings are subsequently measured at amortised cost using the effective interest method.

Gains and losses are recognised in profit or loss when the liabilities are derecognised as well as through the amortisation process.

Borrowing costs are capitalised as part of the cost of a qualifying asset if they are directly attributable to the acquisition, construction or production of that asset. Capitalisation of borrowing costs commences when the activities to prepare the asset for its intended use or sale are in progress and the expenditures and borrowing costs are incurred. Borrowing costs are capitalised until the assets are substantially completed for their intended use or sale. All other borrowing costs are expensed in the period they occur. Borrowing costs consist of interest and other costs that an entity incurs in connection with the borrowing of funds.

Trade and other creditors

Liabilities for trade and other creditors, which are normally settled on 30-90 days terms, and amounts due to related parties are initially recognised at fair value and subsequently measured at amortised cost using the effective interest rate method.

Gains and losses are recognised in profit or loss when the liabilities are derecognised as well as through the amortisation process.

2.14 Impairment of financial assets

At each statement of financial position date, there will be an assessment as to whether there is any objective evidence that a financial asset or a group of financial assets is impaired.

If there is objective evidence that an impairment loss on loans and receivables carried at amortised cost has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows (excluding future credit losses that have not been incurred) discounted at the financial asset’s original effective interest rate (i.e. the effective interest rate computed at initial recognition). The carrying amount of the asset is reduced through the use of an allowance account. The amount of the loss is recognised in profit or loss.

If, in a subsequent period, the amount of the impairment loss decreases and the amount can be related objectively to an event occurring after the impairment was recognised, the previously recognised impairment loss is reversed. Any subsequent reversal of an impairment loss is recognised in profit or loss, to the extent that the carrying value of the asset does not exceed its amortised cost at the reversal date.

2.15 Derecognition of financial assets and liabilities

| a) | Financial assets A financial asset is derecognised where the contractual rights to receive cash flows from the asset have expired which usually coincides with receipt of payments for the asset. On derecognition, the difference between the carrying amount and the sum of the consideration received is recognised in profit or loss. |

| b) | Financial liabilities A financial liability is derecognised when the obligation under the liability is discharged or cancelled or expires. For financial liabilities other than derivatives, gains and losses are recognised in profit or loss when the liabilities are derecognised or impaired, and through the amortisation process. |

2.16 Derivative financial instruments and hedging activities

The Group uses derivative financial instruments such as forward currency contracts and interest rate swaps to hedge its risks associated with foreign currency and interest rate fluctuations.

Derivative financial instruments are initially recognised at fair value on the contract date and are subsequently re-measured at fair value. Derivative financial instruments are carried as assets when the fair value is positive and as liabilities when the fair value is negative.

Any gains or losses arising from changes in fair value on derivative financial instruments that do not qualify for hedge accounting are taken to profit or loss for the year.

The fair values of forward currency contracts are calculated by reference to current forward exchange rates for contracts with similar maturity profiles. The fair value of interest rate swap contract is determined by reference to market value for similar instruments.

The Group applies hedge accounting for certain hedging relationships which qualify for hedge accounting.

At the inception of a hedge relationship, the Group formally designates and documents the hedge relationship to which the Group wishes to apply hedge accounting and the risk management objective and strategy for undertaking the hedge. The documentation includes identification of the hedging instrument, the hedged item or transaction, the nature of the risk being hedged and how the entity will assess the hedging instrument’s effectiveness in offsetting the exposure to changes in the hedged item’s fair value or cash flows attributable to the hedged risk.

Such hedges are expected to be highly effective in achieving offsetting changes in fair value or cash flows and are assessed on an ongoing basis to determine that they actually have been highly effective throughout the financial reporting periods.

Hedges which meet the strict criteria for hedge accounting are accounted for as follows:

-

Fair value hedges

For fair value hedges, the carrying amount of the hedged item is adjusted for gains and losses attributable to the risk being hedged, the derivative is re-measured at fair value and gains and losses from both are taken to profit or loss.

The Group discontinues fair value hedge accounting if the hedging instrument expires or is sold, terminated or exercised, the hedge no longer meets the criteria for hedge accounting or the Group revokes the designation. Any adjustment to the carrying amount of a hedged financial instrument for which the effective interest method is used is amortised to profit or loss.

-

Cash flow hedges

For cash flow hedges, the effective portion of the gain or loss on the hedging instrument is recognised directly in the hedging reserve, while the ineffective portion is recognised in profit or loss.

Amounts taken to hedging reserve are transferred to profit or loss when the hedged transaction affects profit or loss, such as when hedged financial income or financial expense is recognised or when a forecast sale or purchase occurs. Where the hedged item is the cost of a non-financial asset or liability, the amounts taken to hedging reserve are transferred to the initial carrying amount of the non-financial asset or liability.

If the forecast transaction is no longer expected to occur, amounts previously recognised in hedging reserve are transferred to profit or loss. If the hedging instrument expires or is sold, terminated or exercised without replacement or rollover, or if its designation as a hedge is revoked, amounts previously recognised in hedging reserve remain in equity until the forecast transaction occurs. If the related transaction is not expected to occur, the amount is taken to the profit or loss.

2.17 Inventories

Inventories are valued at the lower of cost and net realisable value.

Cost incurred in bringing the inventories to their present location and condition is accounted for on weighted average basis.

Net realisable value is estimated selling price in the normal course of business, less estimated costs necessary to make the sale.

2.18 Provisions

Provisions are recognised when the Group has a present obligation as a result of a past event, it is probable that an outflow of economic resources will be required to settle the obligation and the amount of the obligation can be estimated reliably.

If the effect of the time value of money is material, provisions are discounted using a current pre-tax rate that reflects, where appropriate, the risks specific to the liability. Where discounting is used, the increase in the provision due to the passage of time is recognised as finance costs.

Provisions are reviewed at each statement of financial position date and adjusted to reflect the current best estimate. If it is no longer probable that an outflow of economic resources will be required to settle the obligation, the provision is reversed.

2.19 Government grant

Government grants are recognised at their fair value where there is reasonable assurance that the grant will be received and all attaching conditions will be complied with.

Government grant shall be recognised in profit or loss on a systematic basis over the periods in which the entity recognises as expenses the related costs for which the grants are intended to compensate.

2.20 Employee benefits

| a) | Defined contribution plan The Group makes contributions to the Central Provident Fund (“CPF”) scheme in Singapore, a defined contribution pension scheme. These contributions are recognised as an expense in the period in which the related service is performed. |

| b) | Employee share option plan Employees (including the executive director) and non-executive directors of the Group receive remuneration in the form of share-based payment transactions, whereby employees render services as consideration for share options (‘equity-settled transactions’). The cost of equity-settled transactions with employees is measured by reference to the fair value of the options at the date on which the share options are granted. In valuing the share option, no account is taken of any performance conditions, other than conditions linked to the price of shares of the Company (‘market condition’), if applicable. The cost of equity-settled transactions is amortised and recognised in profit or loss on a straight-line basis over the vesting period, with a corresponding increase in share option reserve. The cumulative expense recognised at each reporting date until the vesting date reflects the extent to which the vesting period has expired and the Group’s best estimate of the number of options that will ultimately vest. The movement in cumulative expenses recognised at the beginning and end of a reporting period is charged or credited to profit or loss with a corresponding adjustment to share option reserve. No expense is recognised for options that do not ultimately vest, except for options where vesting is conditional upon a market condition, which are treated as vested irrespective of whether or not the market condition is satisfied, provided that all other performance conditions are satisfied. |

2.21 Income tax

| a) | Current tax Current tax assets and liabilities are measured at the amount expected to be recovered from or paid to the taxation authorities. The tax rates and tax laws used to compute the amount are those that are enacted or substantively enacted by the statement of financial position date. |

| b) | Deferred tax Deferred tax is provided using the liability method on temporary differences at the statement of financial position date between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes. Deferred tax liabilities are recognised for all temporary differences, except:

Deferred tax assets are recognised for all deductible temporary differences, carry-forward of unused tax assets and unused tax losses, to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, carry-forward of unused tax credits and unused tax losses can be utilised except:

The carrying amount of deferred tax assets is reviewed at each statement of financial position date and reduced to the extent that it is no longer probable that sufficient taxable profit will be available to allow all or part of the deferred tax asset to be utilised. Unrecognised deferred tax assets are reassessed at each statement of financial position date and are recognised to the extent that it has become probable that future taxable profit will allow the deferred tax asset to be recovered. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the year when the asset is realised or the liability is settled, based on tax rates and tax laws that have been enacted or substantively enacted at the statement of financial position date. Deferred income tax relating to items recognised directly in equity is recognised in equity. Deferred tax assets and deferred tax liabilities are offset, if a legally enforceable right exists to set off current tax assets against current tax liabilities and the deferred taxes relate to the same taxable entity and the same taxation authority. |

| c) | Goods and services tax Revenue, expenses and assets are recognised net of the amount of goods and services tax except:

The net amount of goods and services tax recoverable from, or payable to, the taxation authority is included as part of receivables or payables in the statement of financial position. |

2.22 Impairment of non-financial assets

Assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If such an indication exists, the asset’s recoverable amount is estimated. The recoverable amount is the higher of an asset’s or cash generating unit’s fair value less cost to sell and value in use. Value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset up to the end of its useful life. An impairment loss is recognised in profit or loss whenever the carrying value of an asset exceeds its recoverable amount.

Reversal of impairment losses recognised in prior years is recorded when there is an indication that the impairment losses recognised for the asset no longer exist or have decreased. The reversal is recorded in profit or loss. However, the increased carrying amount of an asset due to a reversal of an impairment loss is recognised to the extent it does not exceed the carrying amount that would have been determined (net of amortisation or depreciation) had no impairment loss been recognised for that asset in prior years. After such reversal, the depreciation charge is adjusted in future periods to allocate the assets revised carrying amount less any residual value, on a systematic basis over its remaining useful life.

2.23 Revenue recognition

Revenue of the Group comprises fees earned from telecommunication services rendered and sale of handsets.

Revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group and the revenue can be reliably measured. The following specific recognition criteria must also be met before revenue is recognised:

-

Service revenue is recognised at the time when such services are rendered. Revenue billed in advance of the rendering of services is deferred on the statement of financial position as unearned revenue.

-

Revenue from sale of prepaid cards but for which services have not been rendered is deferred on the statement of financial position as unearned revenue. Upon termination of the prepaid cards, any unutilised value of the prepaid cards will be taken to profit or loss.

-

Revenue from sale of handset is recognised upon the passing of risk and rewards of ownership of the goods to the customer which generally coincides with delivery and acceptance of the handsets sold.

-

Revenue on award credits are recognised based on the number of award credits that have been redeemed in exchange for free or discounted goods, relative to the total numbers of awards credit expected to be redeemed.

-

Interest income is recognised using the effective interest method.

2.24 Customer acquisition and retention costs

Customer acquisition and retention costs are accounted for in the profit and loss statement when incurred.

2.25 Operating leases

Operating lease payments are recognised as an expense in profit or loss on a straight-line basis over the lease term. The aggregate benefit of incentives provided by the lessor is recognised as a reduction of rental expense over the lease term on a straight-line basis.

2.26 Foreign currency

The Group’s consolidated financial statements are presented in Singapore Dollars, which is also the parent and subsidiary companies’ functional currencies.

Transactions in foreign currencies are measured in the respective functional currencies of the Company and its subsidiaries and are recorded on initial recognition in the functional currencies at exchange rates approximating those ruling at the transaction dates. Monetary assets and liabilities denominated in foreign currencies are translated at the closing rate of exchange ruling at the statement of financial position date. Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates as at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value was determined.

Exchange differences arising on the settlement of monetary items or on translating monetary items at the statement of financial position date are recognised in profit or loss.

2.27 Related parties

An entity or individual is considered to be a related party of the Group for the purposes of the financial statements if:

| a) | it possesses ability (directly or indirectly) to control or exercise significant influence over the operating and financial decisions of the Group or vice versa; or |

| b) | it is subject to common control or common significant influence. |

2.28 Segment reporting

The Company and its subsidiaries operate in Singapore in one business segment, that of provision of telecommunications services.

2.29 Share capital and share issuance expenses

Proceeds from issuance of ordinary shares are recognised as share capital in equity.

3. Operating revenue

4. Operating expenses

Cost of services includes traffic expenses, leased circuit costs, fixed services wholesale costs and other base station related costs.

During the financial year ended 31 December 2009, the Singapore Finance Minister announced the introduction of a Jobs Credit Scheme. During the year, the Group received grant income of S$756,000 (2009: S$4,045,000) under the Scheme and this is accounted as a reduction in staff costs.

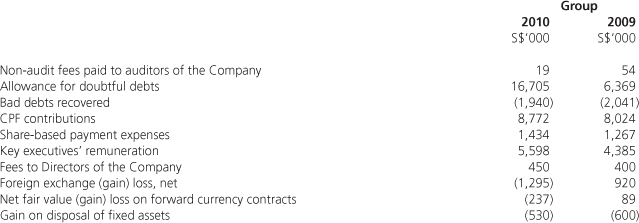

Total operating expenses included the following:

Key executives’ remuneration included in the operating expenses are as follows:

5. Other revenue

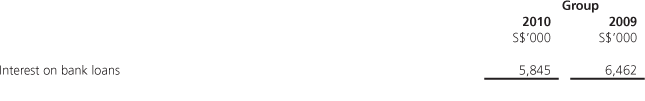

6. Finance costs

7. Taxation

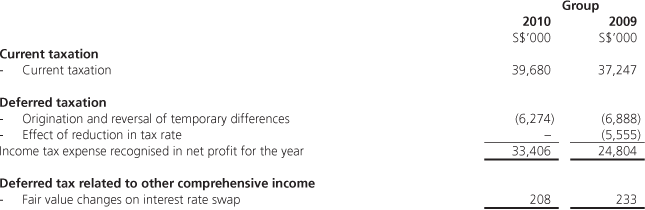

Major components of income tax expense for the years ended 31 December 2010 and 2009 are:

A reconciliation of the statutory tax rate with the effective tax rate applicable to profit before tax of the Group for the years ended 31 December 2010 and 2009 are as follows:

Analysis of deferred tax liabilities:

Deferred tax assets and liabilities

Deferred taxes at 31 December 2010 and 2009 are related to the following:

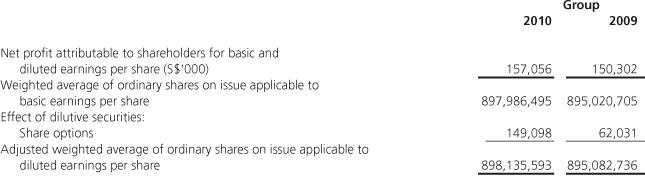

8. Earnings per share

Basic earnings per share is calculated by dividing the net profit for the year attributable to shareholders by the weighted average number of ordinary shares outstanding during the financial year.

Diluted earnings per share is calculated by dividing the net profit for the year attributable to shareholders by the weighted average number of ordinary shares outstanding during the financial year (adjusted for effects of dilutive options).

The following reflects the earnings and share data used in the computation of basic and diluted earnings per share for the financial years ended 31 December:

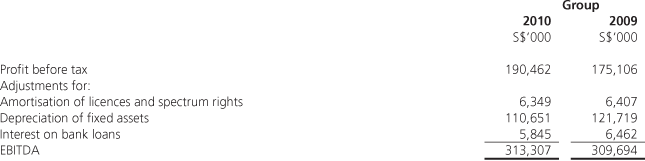

9. Earnings before interest, tax, depreciation and amortisation (“EBITDA”)

EBITDA is defined as follows:

10. Fixed assets

11. Licences and spectrum rights

The licences and spectrum rights have remaining amortisation period ranging from 4.5 years to 11 years (2009: 5.5 years to 12 years).

12. Intangibles

In 2009, the Group’s subsidiary, M1 Net Ltd (M1 Net), acquired a 100% equity interest in M1 Connect Pte. Ltd. (M1 Connect). The Group agreed to pay to some of the selling shareholders potential consideration of S$2.5 million if certain financial targets can be met by M1 Connect for financial periods up to and ending on 30 June 2011. In the current financial year, the Group paid an additional S$1.0 million to certain previous shareholders of M1 Connect after the performance targets were met. This gave rise to an adjustment to goodwill arising from this acquisition.

Impairment testing of goodwill

Management has allocated the goodwill to M1 Net and M1 Connect as a single cash-generating unit (CGU) for impairment testing. The recoverable amount of the CGU has been determined based on value in use calculations using cash flow projections covering a five-year period. The discount rate applied to the cash flow projections and terminal growth rate used to extrapolate cash flow projections beyond the five-year period are 10% and nil respectively.

The calculation of value in use for the CGU is most sensitive to the following assumptions:

Terminal growth rate – The terminal growth rate used does not exceed the long term average growth rate of the industry and country in which the CGU operates.

Pre-tax discount rate – Discount rate reflects the current market assessment of the risks specific to the CGU.

13. Staff loans

Staff loans are repayable in equal monthly instalments over periods of up to seven years and bear interest rate of up to 2% (2009: 2%) per annum.

14. Interests in subsidiaries

Details of the subsidiaries of the Company as at 31 December 2010 are as follows:

All subsidiaries are audited by Ernst & Young LLP except for Kliq Pte Ltd for which there is no statutory audit requirement.

15. Joint venture

The Group has a 50% joint venture with PLDT (SG) Retail Service Pte Ltd. The principal activity of this joint venture is provision of prepaid mobile services.

The aggregate amounts of each of current assets, non-current assets, current liabilities, income and expenses related to the Group’s interests in the jointly-controlled operation are as follows:

16. Inventories

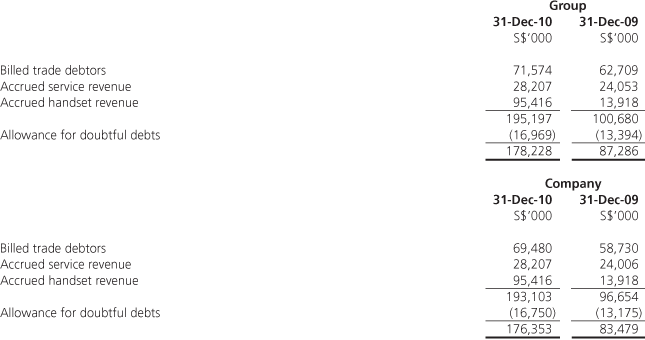

17. Trade debtors

Trade debtors comprise of billed trade debtors, accrued service revenue and accrued handset revenue.

Billed trade debtors are non-interest bearing and are generally on 30 to 90 days terms. They are recognised at their original invoice amounts which represent their fair values on initial recognition.

Debtors that are past due but not impaired:

The Group and Company have unsecured trade debtors that are past due at the statement of financial position date but not impaired and the analysis of their ageing at the statement of financial position date is as follows:

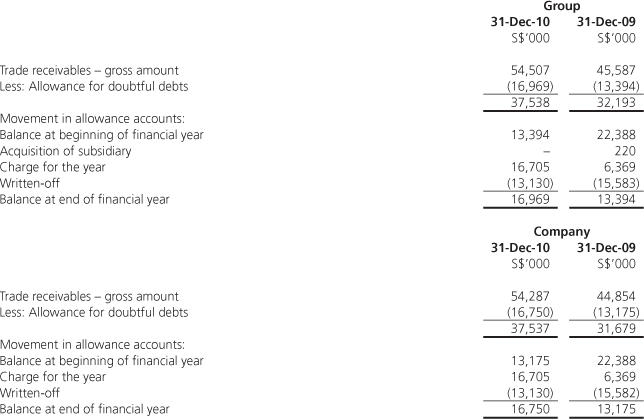

Debtors that are impaired:

The Group’s and Company’s trade debtors that are impaired at the end of the reporting period and the movement of the allowance accounts used to record impairment are as follows:

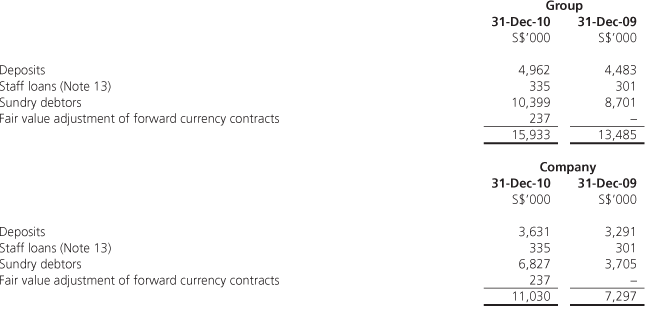

18. Other debtors and deposits

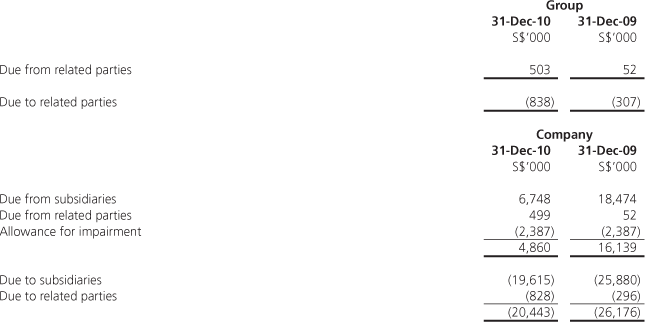

19. Due from/(to) related parties and subsidiaries (trade)

The amounts due from/(to) related parties are unsecured, non-interest bearing and are generally on 30 to 90 days terms.

20. Cash and cash equivalents

Cash and cash equivalents comprises cash on hand and at banks, and time deposits which earn interest at floating rates offered by short-term money market ranging from 0.05% to 0.42% (2009: 0.01% to 0.70%) per annum. Time deposits are made for varying periods of between 1 day and 2 months depending on the immediate cash requirements of the Group and Company.

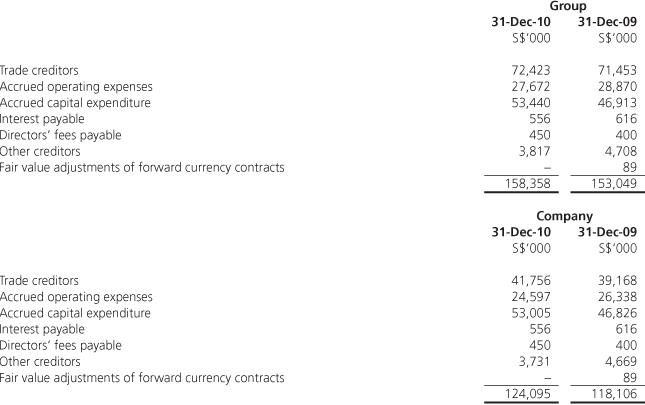

21. Creditors and accruals

Trade and other payables are non-interest bearing and are normally settled on 30 to 90 days term.

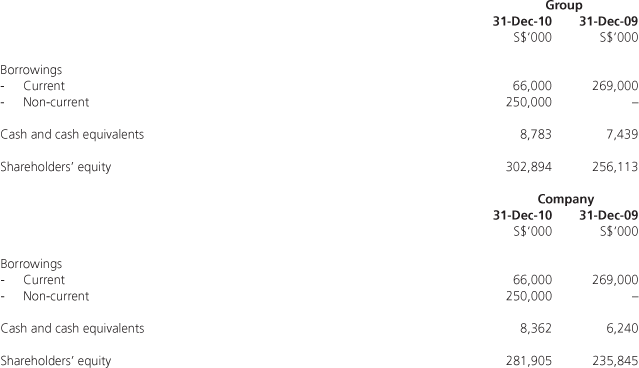

22. Borrowings

The S$66 million (2009: S$19 million) short-term loans are unsecured, bear interest at rates ranging from 0.69% to 0.70% (2009: 1.16% to 1.20%) per annum and are repayable in full in January 2011 (2009: January 2010).

The S$250 million long term loans are unsecured and are repayable in full in May 2013. They consist of a S$125 million fixed rate loan at an effective rate of 2.6% per annum and a S$125 million floating rate loan. The S$125 million floating rate loan bear interest at a rate which is based on the variable Singapore Dollar Swap Offer Rate, payable semi-annually every November and May.

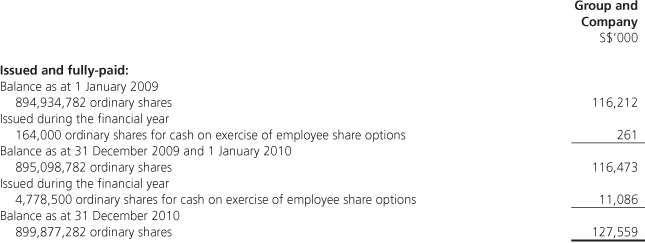

23. Share capital

The holders of ordinary shares are entitled to receive dividends as and when declared by the Company. All ordinary shares carry one vote per share without restrictions. The ordinary shares have no par value.

The Company has an employee share option scheme (Note 27) under which options to subscribe for the Company’s ordinary shares have been granted to employees (including executive director) and non-executive directors of the Company and its subsidiaries.

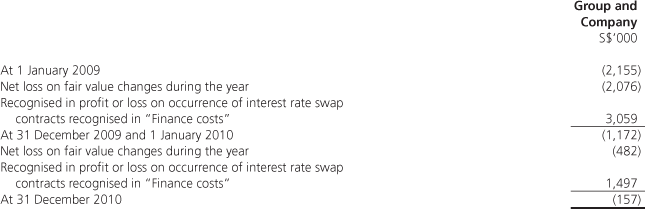

24. Hedging reserve

Hedging reserve records the portion of the fair value changes on derivative financial instruments designated as hedge instruments in cash flow hedges that is determined to be an effective hedge.

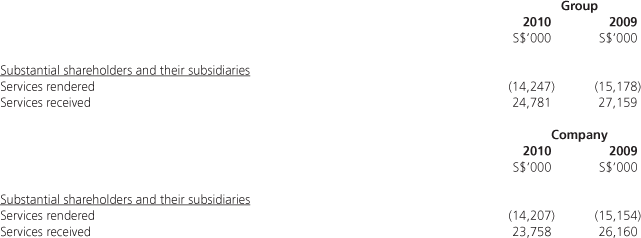

25. Related party transactions

In addition to the related party information disclosed elsewhere in the financial statements, the following were significant transactions entered into by the Group and related parties who are not members of the Group at market rates during the financial year:

26. Commitments

| a) | Capital commitments Capital expenditure contracted for as at the statement of financial position date but not recognised in the financial statements are as follows:  |

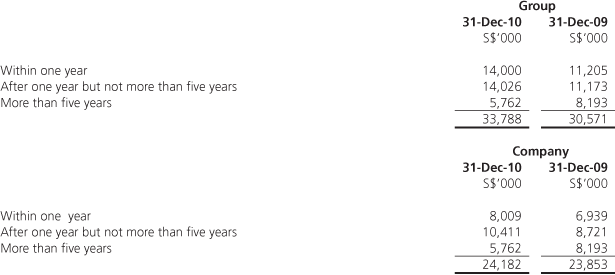

| b) | Operating lease commitments Rental expenses (principally for land, offices, retail outlets, service centres and base stations) were S$25,516,000 and S$23,363,000 for the financial years ended 31 December 2010 and 2009 respectively. The Group leases various properties under operating lease agreements. These leases have varying terms, escalation clauses and renewal rights. The future minimum lease payments are as follows:  |

27. Share options

The Company has an employee share option scheme, M1 Share Option Scheme (the “Scheme”), for granting of non-transferable options to employees (including executive director) and non-executive directors of the Company and its subsidiaries.

The Remuneration Committee is responsible for administering the Scheme. The Remuneration Committee members are Mr Roger Barlow (Chairman of Committee), Mr Chow Kok Kee, Mr Low Huan Ping, Mr Alan Ow Soon Sian and Mr Teo Soon Hoe.

Under the Scheme, options granted have a term of 5 years or 10 years from the date of grant for non-executive directors and Group executives respectively.

The subscription price for each ordinary share in respect of which an option is exercisable shall be determined by the Remuneration Committee as follows:

| i) | at a price equal to the average of the last dealt prices of the Company’s shares on the Singapore Exchange Securities Trading Limited over the five consecutive trading days immediately preceding the date of grant of that option (the “Market Price”) or such higher price as may be determined by the Remuneration Committee in its absolute discretion; or |

| ii) | at a price, which is set at the absolute discretion of the Remuneration Committee, at a discount to the Market Price so long as the maximum discount for any option shall not exceed 20% of the Market Price in respect of that option. |

For good corporate governance, the Remuneration Committee had in 2003 resolved that the date of grant of share options under the Scheme shall be a pre-determined date; that is, the date falling 14 days immediately after the date of announcement of the Company’s full-year results.

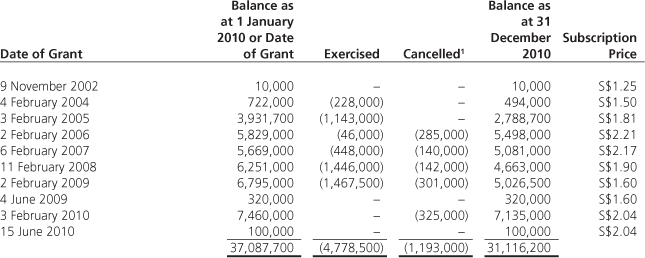

Information with respect to the number of options granted under the Scheme is as follows:

1 Cancelled when staff resigned from the Company

The above options will vest over a period of three years from the date of grant and may be exercisable for a period commencing after the first anniversary of the date of grant and expiring on the 10th anniversary of the date of grant.

The weighted average fair value of options granted during the financial year was S$0.23 (2009: S$0.22).

The weighted average share price at the date of exercise of the options exercised during the financial year was S$2.13 (2009: S$1.74).

The weighted average remaining contractual life for options outstanding at the end of the financial year is 6.9 years (31 December 2009: 7.3 years).

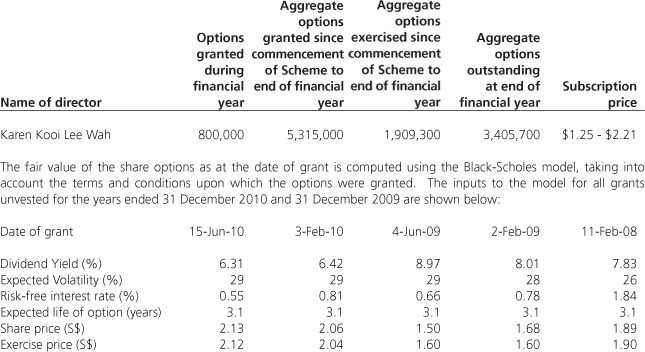

Information on a director of the Company participating in the Scheme is as follows:

The expected life of the option is based on historical date and is not necessary indicative of exercise patterns that may occur. The expected volatility reflects the assumption that historical volatility is indicative of future trends, which may also not necessarily be the actual outcome. No other features of the option were incorporated into the measurement of fair value.

28. Financial risk management objectives and policies

The Group’s instruments are, in the normal course of business, exposed to interest rate, foreign currency, credit and liquidity risks. The Group’s risk management strategy aims to minimise the adverse effects of financial risk on the financial performance of the Group. The Group also enters into derivative transactions, including interest rate swaps and forward currency contracts. The purpose is to manage the interest rate and currency risks arising from the Group’s operations and its sources of financing. There has been no change to the Group’s exposure to these financial risks or the manner in which it manages and measures the risks.

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of the Group’s and the Company’s financial instruments will fluctuate because of changes in market interest rates. The Group’s and the Company’s exposure to interest rate risk arises primarily from the Group’s long-term debt obligation.

The Group’s policy is to manage its interest cost using a mix of variable and fixed rate debts. To manage this mix in a cost-efficient manner, the Group enters into interest rate swaps, in which the Group agrees to exchange, at specified intervals, the difference between fixed and variable interest amounts calculated by reference to an agreed-upon notional principal amount. These swaps are designated to hedge underlying debt obligations. As at 31 December 2010 and 2009, after taking into account the effect of interest rate swap, all of the Group’s long-term borrowings are at fixed rates of interest.

Foreign currency risk

The Group’s revenue and expenditure are primarily transacted in Singapore dollar. The currency exposures are limited to US dollars (“USD”) and Special Drawing Rights (“SDR”). SDR is an international reserve asset created by International Monetary Fund and is valued on the basis of a basket of key national currencies.

The Group and the Company also hold cash and cash equivalents denominated in foreign currencies for working capital purposes. At the statement of financial position date, such foreign currency balances (mainly in USD and Euro) amount to S$2,611,000 (31 December 2009: S$2,522,000) for both the Group and the Company.

Whenever possible, foreign currency transactions are matched to minimise the exposure. The exchange rates are continually monitored and forward contracts are used when appropriate to hedge against exchange rate fluctuations.

As at the statement of financial position date, the Group’s currency exposures are insignificant.

Liquidity risk

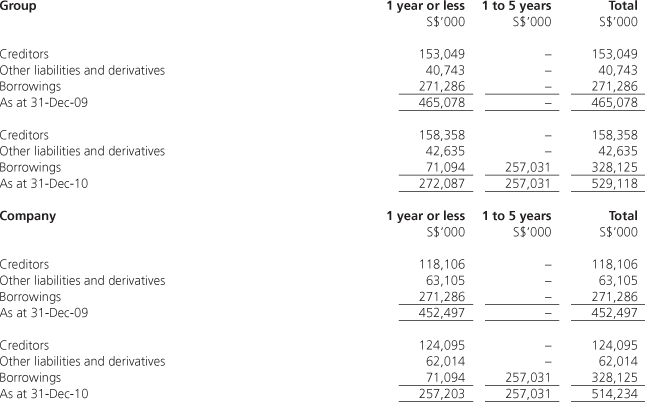

Liquidity risk is the risk that the Group or the Company will encounter difficulty in meeting financial obligations due to shortage of funds. The Group’s and the Company’s exposure to liquidity risk arises primarily from mismatches of the maturities of financial assets and liabilities. The Group relies on its internal working capital and bank borrowings to fund most of its operating and investing activities. There are sufficient revolving credit facilities available to meet short term funding requirements.

The table below summarises the maturity profile of the Group’s and Company’s financial liabilities at the statement of financial position date based on contractual undiscounted payments.

Credit risk

Credit risk is the risk of loss that may arise on outstanding financial instruments should a counterparty default on its obligations. The Group’s credit risk is mitigated by its combination of cash and credit sales. For credit sales, the Group has no significant concentration of credit risk from trade debtors due to its diverse customer base. Credit risk is managed through credit checks, credit reviews and monitoring procedures that includes a formal automated collection process.

The Group’s maximum exposure to credit risk in the event the counter-parties fail to perform their obligations as of 31 December 2010 in relation to each class of recognised financial assets, other than derivatives, is the carrying amount of those assets as indicated in the statement of financial position.

29. Fair values of financial instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged or settled between knowledgeable and willing parties in an arm’s length transaction, other than in forced or liquidation sale.

Financial instruments carried at fair value

The Company has carried all derivative financial instruments at their fair value as required by FRS 39. The following table shows an analysis of financial instruments carried at fair value by level of fair value hierarchy:

Fair value hierarchy

The Group classifies fair value measurement using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. The fair value hierarchy have the following levels:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices), and

Level 3 – Inputs for the asset or liability that are not based on observable market data (unobservable inputs)

Determination of fair value

Derivatives (Note 30): Forward currency contracts and interest rate swap contracts are valued using a valuation technique with market observable inputs. The most frequently applied valuation techniques include forward pricing and swap models, using present value calculations. The models incorporate various inputs including the credit quality of counterparties, foreign exchange spot and forward rates and interest rate curves.

Financial instruments whose carrying amount approximate fair value

Management has determined that the carrying amounts of current trade debtors, other debtors, due from related parties, cash and cash equivalents, creditors, due to related parties and borrowings, based on their notional amounts, are reasonable approximation of fair values either due to their short-term nature or they are floating rate instruments that are re-priced to market rates on or near the statement of financial position date.

30. Derivatives

As at 31 December 2010, the Company has one (31 December 2009: two) interest rate swap agreement in place with notional amount of S$125 million, whereby it receives interest at the variable Singapore Dollar Swap Offer Rate and pays interest at a fixed Singapore Dollar rate of 1.579% (2009: 1.74% to 3.00%) per annum semi-annually every November and May.

This swap is designated as cash flow hedge and being used to hedge the cash flow interest rate risk of the Company’s floating rate long-term loan. The interest rate swap and the floating rate long-term loan have the same critical terms and notional amount of S$125 million.

The fair value (liability position) of the interest rate swap at 31 December 2010 was S$189,000 (31 December 2009: S$1,412,000), which is included in hedging reserve. There was no impact to profit or loss.

The forward currency contracts of notional amounts S$14,539,000 (2009: S$17,115,000) are used to hedge foreign currency risk arising from the Group’s purchases denominated in USD and Euros. The Group does not apply hedge accounting for these forward currency contracts. The fair value gain/(loss) of the forward currency contracts at 31 December 2010 was S$237,000 (31 December 2009: (S$89,000))

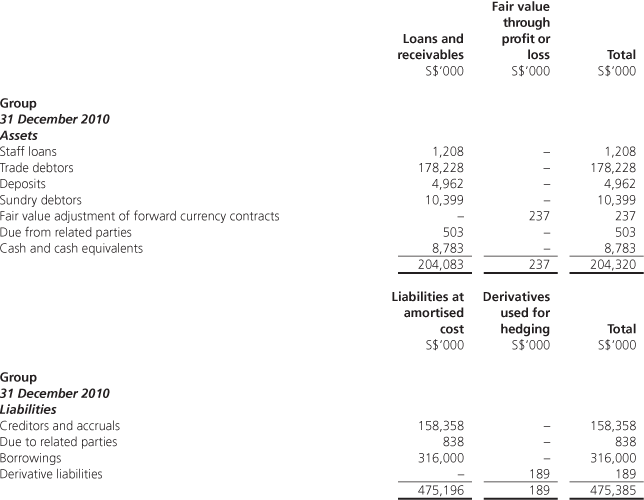

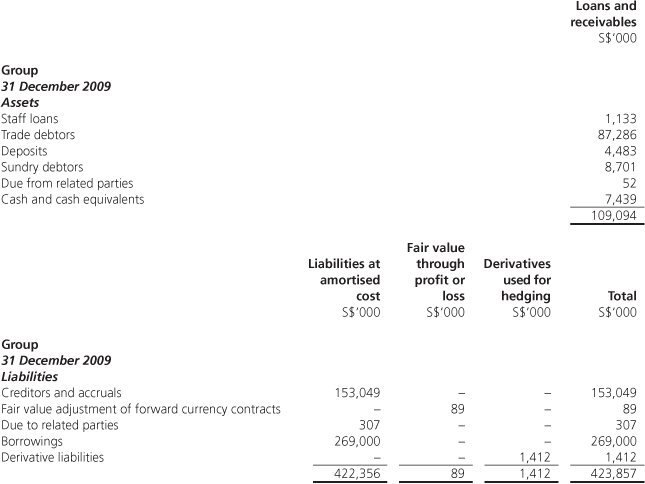

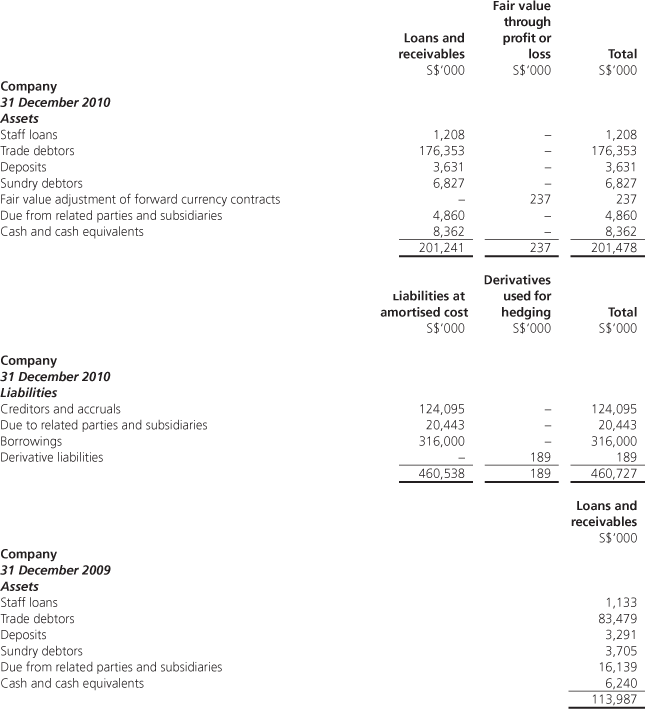

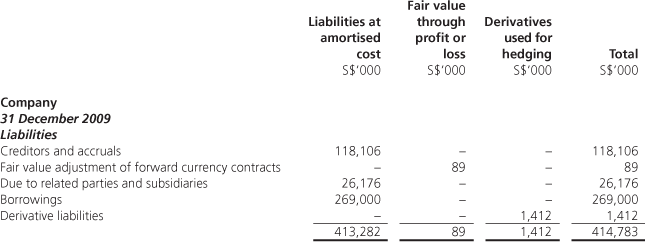

31. Classification of financial instruments

The following table shows a comparison by category of carrying amounts of the Group’s and Company’s financial assets and liabilities that are carried in the financial statements:

32. Capital management

The objective of the Group’s capital management policy is to provide capacity to support business requirements and to take advantage of business opportunities that might arise, so as to enhance shareholder value. With prudent capital management, the Group aims to maintain a sustainable regular payout ratio.

The capital structure of the Group consists of borrowings, cash and cash equivalents and shareholders’ equity.

There was no change in the Group’s approach to capital management during the year.

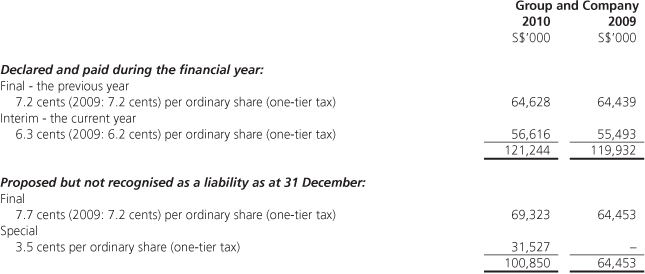

33. Dividends

The directors propose that a final dividend of 7.7 cents per ordinary share (one-tier tax) and a special dividend of 3.5 cents per ordinary share (one-tier tax) in respect of the financial year ended 31 December 2010 for approval by shareholders at the forthcoming Annual General Meeting of the Company.

34. Authorisation of financial statements

The financial statements for the year ended 31 December 2010 were authorised for issue in accordance with a resolution of the directors on 18 February 2011.