|

Operating Revenue

| |

Year Ended 31 Dec |

| Operating revenue |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Mobile telecommunications services |

568.9 |

582.9 |

-2.4%

|

| International call services |

114.0 |

121.8 |

-6.4% |

| Others |

0.7 |

0.2 |

250.0% |

| Total service revenue |

683.6 |

704.9 |

-3.0% |

| Handset sales |

89.4 |

73.3 |

22.0% |

| Total |

773.0 |

778.2 |

-0.7% |

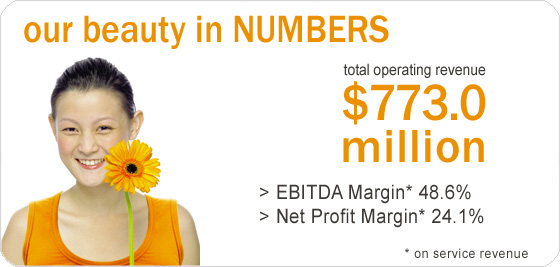

For 2006, M1’s total operating revenue decreased 0.7% to S$773.0 million, due mainly to lower total service revenue during the first three quarters of the year. For the first nine months of 2006, M1’s performance was adversely affected in the prepaid segment by the registration exercise in first half of 2006, as well as by increased competition in the value segment for international call services. Further, mobile voice revenue remained under pressure, while data revenue will take time to contribute meaningfully. Nevertheless, on a sequential basis, total service revenue in the fourth quarter of 2006 increased 3.6%, reversing the decline of the previous quarters.

Mobile Telecommunications

| |

Year Ended 31 Dec |

| Mobile telecommunications revenue |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Post-paid |

507.0 |

516.9 |

-1.9% |

| Pre-paid |

61.9 |

66.0 |

-6.2% |

| Total |

568.9 |

582.9 |

-2.4% |

| |

|

|

|

| Average revenue per user (ARPU, S$ per month) |

|

|

|

| Post-paid (excluding Data plan) |

60.2 |

61.1 |

-1.5% |

| Data plan |

34.7 |

23.9 |

45.2% |

| Pre-paid |

19.0 |

21.0 |

-9.5% |

| Non-voice services as contribution to blended ARPU (%) |

20.5 |

19.4 |

- |

Mobile telecommunications revenue decreased 2.4% to $568.9 million due mainly to declines in the first three quarters of 2006. During the prepaid registration exercise in the first half of 2006, M1 introduced incentives to encourage prepaid users to register their cards. This had a negative effect on both prepaid revenue and ARPU, which declined 6.2% and 9.5% respectively in 2006. Postpaid revenue and ARPU declined 1.9% and 1.5% respectively as a result of lower chargeable voice usage. However, as a result of various initiatives launched in second half of 2006 (please refer to “Mobile Services” section of Operating and Financial Review), both postpaid and prepaid revenues as well as ARPU improved sequentially in the fourth quarter of 2006.

In view of the increased emphasis on mobile data offerings, M1 took the initiative to commence reporting Data plan ARPU separately. Data plan comprises mainly 3G SunSurf plans, Blackberry plans and M1 Broadband plans. Data plan ARPU increased 45.2% year-on-year to S$34.7 for 2006 due mainly to increased take-up of 3G data cards on unlimited plans in

the second half of 2006. The broadband plans launched in December 2006 were well-received but any revenue impact will only be felt in 2007.

Non-voice services’ contribution to ARPU increased from 19.4% to 20.5% due to higher usage of data services, such as email, access to Internet, and video and music downloads.

International Call Services

| |

Year Ended 31 Dec |

| International call service revenue |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Retail |

104.6 |

110.9 |

-5.7% |

| Wholesale & bilateral |

9.4 |

11.0 |

-14.5% |

| Total |

114.0 |

121.8 |

-6.4% |

International call service revenue decreased 6.4% to $114.0 million as traffic fell from 210 to 206 million minutes.

The decline was due to continual pressure in the value segment. However, on a sequential basis, revenue and retail minutes in the fourth quarter of 2006 increased 8.0% and 11.8% respectively. This was due mainly to several initiatives introduced in the second half of 2006, including revised tariffs to several countries, bundled promotions with M1’s international calling and prepaid cards, as well as growth in corporate segment IDD.

Handset Sales

Handset sales increased 22.0% YoY to $89.4 million, driven mainly by higher volume and marginally higher selling prices.

Operating Expenses

| |

Year Ended 31 Dec |

| |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Cost of sales |

270.6 |

263.3 |

2.8% |

| Staff costs |

88.1 |

90.3 |

-2.4% |

| Advertising & promotion |

17.6 |

23.1 |

-23.8% |

| Depreciation & amortisation |

112.4 |

120.3 |

-6.6% |

| Provision for bad & doubtful debt |

18.9 |

20.3 |

-6.9% |

| Other general & administrative expenses |

51.4 |

52.0 |

-1.2% |

| Total |

559.0 |

569.2 |

-1.8% |

Total operating expenses decreased 1.8% to $559.0 million due to lower traffic expenses, leased circuit cost, staff cost, advertising and promotion, depreciation and doubtful debt provision. As a percentage of operating revenue, it decreased

0.8 percentage point to 72.3%.

Cost of Sales

| |

Year Ended 31 Dec |

| |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Handset cost |

137.2 |

120.4 |

14.0% |

| Traffic expenses |

31.0 |

37.9 |

-18.2% |

| Leased circuit cost |

30.1 |

36.1 |

-16.6% |

| Other cost |

72.3 |

68.9 |

4.9% |

| Total |

270.6 |

263.3 |

2.8% |

Cost of sales increased 2.8% YoY to $270.6 million. Main cost drivers were handset costs and dealers’ commission which is classified under “Other” cost (comprising base station facilities expenses, billing fees, licence fees and dealers’ commission). These were partly offset by lower traffic expenses and leased circuit costs.

Staff Costs

Staff costs decreased 2.4% to $88.1 million mainly due to temporary shortfall in headcount.

Advertising & Promotion Expenses

Advertising and promotion expenses fell 23.8% to $17.6 million mainly due to lower media spend.

Depreciation & Amortisation

Depreciation and amortisation expense decreased 6.6% to $112.4m as a major system, which was upgraded and still in service, was fully depreciated in 2005.

Provision for Bad & Doubtful Debt

Provision for bad and doubtful debt fell 6.9% to $18.9 million due to higher GST bad debt relief claimed in 2006.

Other General & Administrative Expenses

Other general and administrative expenses decreased 1.2% to $51.4 million as a result of lower general expenses partially offset by higher repair & maintenance expenses.

Finance Costs

Finance costs remained stable at $10.3 million for both 2006 and 2005, as M1’s debt position did not change during the year.

Taxation

Provision for taxation increased 8.8% to $44.4 million, as 2005 benefited from a credit adjustment. The effective tax rate for FY2006 was 21.3%, higher than the statutory 20.0% due to non-deductible expenses.

net profit

| |

Year Ended 31 Dec |

| |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Net profit |

164.6 |

161.0 |

2.2% |

| Net profit margin (%) |

24.1 |

22.8 |

- |

| (on service revenue) |

|

|

|

Consequently, net profit improved 2.2% to $164.6 million, and margin improved to 24.1%.

EBITDA

| |

Year Ended 31 Dec |

| |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| EBITDA |

331.7 |

332.4 |

-0.2% |

| EBITDA margin (%) |

48.6 |

47.2 |

- |

| (on service revenue) |

|

|

|

EBITDA decreased slightly by 0.2% to $331.7 million, but margin improved to 48.6% for 2006.

Capital expenditure and commitments

Capital expenditure incurred for FY2006 was $54.6 million, down from S$62.3 million in the previous year mainly due to lower spend for the 2G network.

Capital commitment as at 31 December 2006 was minimal.

Liquidity and Capital Resources

| |

Year Ended 31 Dec |

| |

2006

S$’m |

2005

S$’m |

YoY

Change |

| |

|

|

|

| Profit before tax |

209.0 |

201.8 |

3.6% |

| Net change in working capital |

(25.9) |

(98.1) |

-73.9% |

| Other adjustments for non-cash items & interest paid/received |

114.2 |

122.0 |

-6.6% |

| Net cash provided by operating activities |

297.3 |

225.7 |

31.8% |

| Net cash used in investing activities |

(54.4) |

(63.4) |

-14.2% |

| Net cash used in financing activities |

(249.7) |

(99.4) |

151.2% |

| Net change in cash and cash equivalents |

(6.8) |

62.8 |

-110.8% |

| Cash and cash equivalents at beginning of financial period |

175.4 |

112.6 |

55.8% |

| Cash and cash equivalents at end of financial period |

168.6 |

175.4 |

-3.8% |

| Free cash flow (1) |

242.7 |

163.4 |

48.5% |

(1)

Operating cash flow increased 31.8% to $297.3 million as working capital improved due to lower payment for accrued capital expenditure. Hence, free cash flow also increased 48.5% to $242.7 million as a result of the higher operating cash flow and lower capital expenditure.

Gearing

As at end of December 2006, net debt to equity ratio was 21.3%, up from 16.1% a year ago. Interest coverage ratio (EBITDA/Interest) remained stable at 32.3x for 2006, compared to 32.4x for 2005.

|