Operating Highlights

| 2015 | 2014 | Change (%) | |

| Mobile Telecommunications | |||

| Number of mobile customers ('000) | |||

| Postpaid | 1,195 | 1,149 | 3.9 |

| Prepaid | 733 | 703 | 4.3 |

| Total | 1,928 | 1,852 | 4.1 |

| Market share1 (%) | |||

| Postpaid | 24.6 | 24.5 | – |

| Prepaid | 21.7 | 20.7 | – |

| Overall | 23.4 | 22.9 | – |

| Singapore mobile penetration rate1 (%) | 148.4 | 148.0 | – |

| Average revenue per user (ARPU, S$ per month) | |||

| Postpaid (excludes Data plan) | 61.7 | 62.4 | -1.1 |

| Postpaid (excludes Data plan and adjusted)2 | 54.2 | 55.6 | -2.5 |

| Data plan | 17.1 | 18.9 | -9.5 |

| Prepaid | 14.7 | 14.5 | 1.4 |

| Mobile data as a % of service revenue | 46.3 | 35.6 | – |

| Average monthly churn rate (%) | 1.0 | 1.1 | – |

| Acquisition cost per postpaid customer (S$) | 363 | 355 | 2.3 |

| Fixed Services | |||

| Number of fibre customers ('000) | 128 | 103 | 23.6 |

| ARPU (Fibre, S$ per month) | 46.7 | 43.9 | 6.4 |

| 1 | Based on IDA statistics as at December 2015 |

| 2 | After adjustment for ARPU allocated to handset sales |

Financial Highlights

| 2015 | 2014 | Change (%) | |

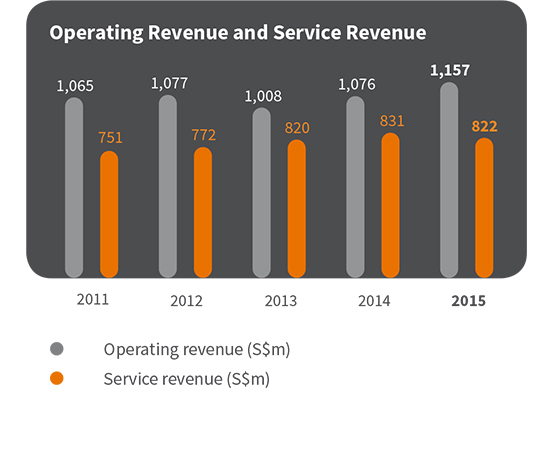

| Operating revenue (S$m) | 1,157.2 | 1,076.3 | 7.5 |

| Mobile telecommunications | 667.7 | 671.1 | -0.5 |

| International call services | 68.7 | 89.4 | -23.1 |

| Fixed services | 85.9 | 70.6 | 21.7 |

| Handset sales | 334.9 | 245.3 | 36.6 |

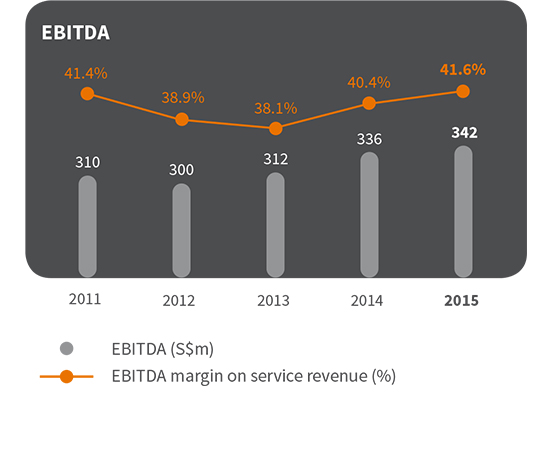

| EBITDA (S$m) | 341.8 | 335.5 | 1.9 |

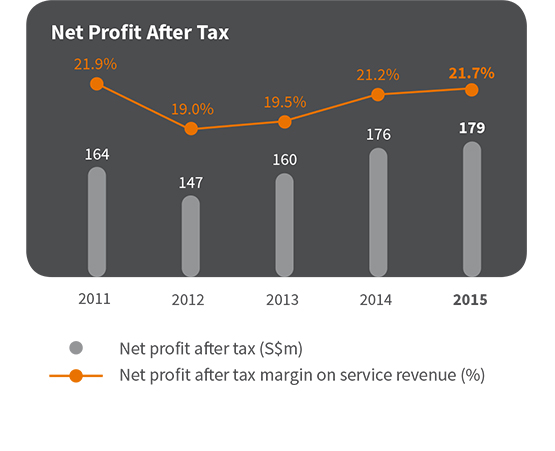

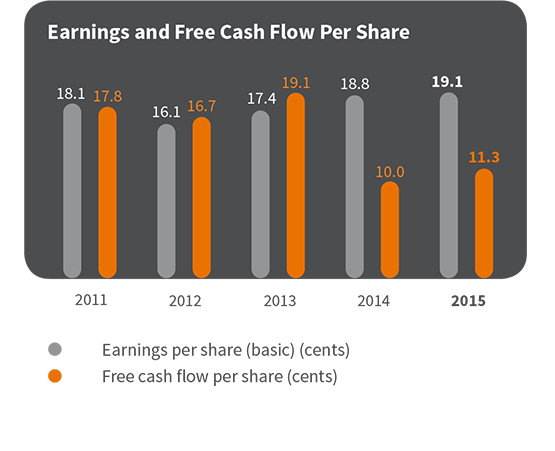

| Net profit after tax (S$m) | 178.5 | 175.8 | 1.5 |

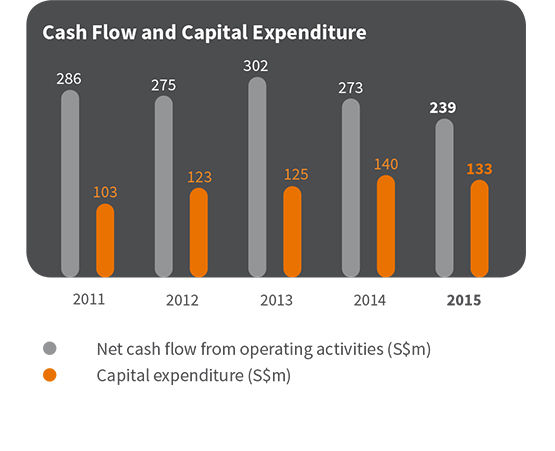

| Free cash flow (S$m) | 105.7 | 93.2 | 13.4 |

| Net assets (S$m) | 413.2 | 394.6 | 4.7 |

| Net debt (S$m) | 343.8 | 279.2 | 23.1 |

| Financial ratios | |||

| Net debt/equity (x) | 0.8 | 0.7 | 17.5 |

| Net debt/EBITDA (x) | 1.0 | 0.8 | 20.9 |

| EBITDA/interest (x) | 69.5 | 83.0 | -16.3 |

| ROE (%) | 44.2 | 44.5 | – |

| ROCE (%) | 25.1 | 26.8 | – |

Note: Figures may not add up due to rounding